Paint Cans Market Overview

The global paint cans market continues to experience steady expansion, fueled by rising construction activities, home renovation trends, and the growing demand for sustainable packaging solutions. Valued at approximately USD 38.2 billion in 2025, the market is projected to reach USD 76.6 billion by 2035, reflecting a robust compound annual growth rate (CAGR) of 7.2%. This growth underscores the critical role of paint cans in securely delivering architectural coatings, industrial paints, and consumer products worldwide.

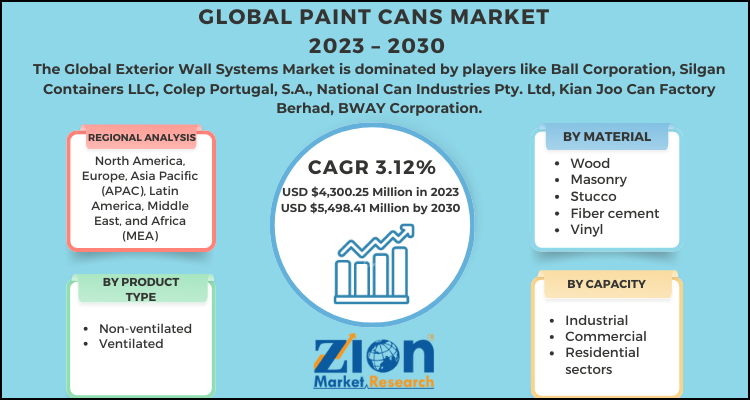

Market Size and Growth Projections

Market analysts forecast significant expansion over the next decade, driven by urbanization and infrastructure development. From 2025 to 2030, the sector is expected to grow from USD 38.2 billion to USD 54.1 billion, accounting for 41.2% of the total projected increase. The subsequent period, 2030 to 2035, anticipates even stronger momentum, adding USD 22.7 billion to reach USD 76.6 billion, propelled by innovations in packaging technology.

Discrepancies exist across reports due to varying scopes, with some estimating a 2024 base of USD 5.15 billion growing to USD 7.44 billion by 2032 at a 4.7% CAGR. Others project from USD 35.4 billion in 2024 to USD 75 billion by 2034 at 7.8% CAGR, highlighting broader inclusions like hybrid materials. These projections emphasize resilience amid economic fluctuations, supported by DIY culture and industrial applications.

Key Market Drivers

Construction booms, particularly in Asia-Pacific, sustain demand for durable paint packaging. Home improvement trends in North America and Europe further boost consumption, alongside automotive and marine coatings needs. Sustainability pushes favor recyclable metal cans, which dominate due to superior barrier properties and recycling infrastructure.

Advancements in manufacturing, such as easy-open lids and stackable designs, enhance efficiency and appeal. Regulatory pressures for eco-friendly materials also drive innovation, reducing reliance on single-use plastics. Overall, these factors position the market for sustained upward trajectory through 2035.

Segment Analysis by Material Type

Metal cans lead with a 68% market share in 2025, prized for durability, airtight seals, and recyclability in architectural and industrial uses. Plastic cans follow, offering lightweight alternatives for retail segments, while composite and hybrid options gain traction for specialized applications.

Metal’s dominance stems from its protective qualities against corrosion and light, essential for long-shelf-life paints. Plastics appeal in cost-sensitive, low-volume scenarios, though environmental concerns limit growth. Hybrids blend benefits, emerging as a niche but promising category.

Segment Analysis by Capacity

Capacity segments cater to diverse users: below 1 liter for consumer DIY, 1-4 liters for household projects, 4-20 liters for professionals, and above 20 liters for industrial bulk. Smaller sizes (1000 ml and below) prevail in retail, while larger ones serve contractors and manufacturers

This breakdown aligns with end-use patterns, with 1-4 liter cans popular in architectural painting (54% share). Growth in mid-range capacities reflects rising professional renovations globally.

Segment Analysis by End-Use Application

Architectural coatings command 54% of the market in 2025, driven by residential and commercial painting. Industrial applications, including automotive and protective coatings, follow, bolstered by manufacturing expansions. Domestic/DIY segments thrive on consumer trends, while lite industrial painting supports smaller operations.

Architectural’s lead ties to urbanization, with industrial growth linked to sectors like marine and aerospace. These segments highlight the market’s versatility across consumer and B2B channels.

Regional Insights

Asia-Pacific, led by China at 9.1% CAGR, dominates due to urbanization and infrastructure. North America (USA at 6.8%) benefits from renovations and eco-initiatives. Europe (Germany 6.4%, UK 6.2%) emphasizes premium coatings, while Japan grows at 5.8% via tech advancements.

China’s manufacturing prowess and the USA’s DIY surge exemplify regional strengths. Emerging markets amplify global dynamics.

Competitive Landscape

Key players like Crown Holdings, Ball Corporation, and Sonoco Products lead with innovations in coatings and closures. Competition focuses on sustainability, supply chain efficiency, and customization. Strategic investments in R&D ensure market share amid raw material volatility.

Challenges and Opportunities

Raw material price swings (steel, aluminum) pose risks, alongside plastic regulations. Opportunities lie in sustainable hybrids and smart packaging tech. Navigating these will define leaders through 2035.