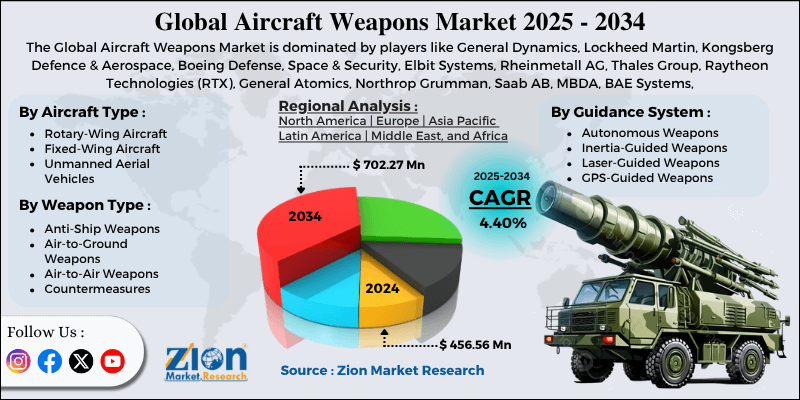

The global aircraft weapons market is undergoing a profound transformation. No longer defined solely by raw explosive power, the sector is now driven by the imperatives of precision, connectivity, and adaptability in increasingly contested airspace. As geopolitical tensions rise and near-peer competitor capabilities advance, nations are investing heavily in next-generation armaments that are smarter, longer-range, and more integrated than ever before.

Market Drivers: Beyond the Battlefield

Several key factors are fueling significant growth and innovation in this multi-billion dollar market:

-

Modernization of Aging Fleets: Major air forces worldwide are upgrading legacy aircraft (like the F-16, F/A-18, and Typhoon) with new weapons to maintain relevance against advanced air defenses, delaying the need for costly new platforms.

-

The Rise of 5th-Generation Warfare: Stealth aircraft like the F-35 Lightning II and Su-57 require weapons that fit internally to preserve their low-observable profile. This has spurred demand for “smart,” compact munitions with reduced radar cross-sections.

-

Multi-Domain Integration: Modern combat requires seamless communication. The new paradigm is the networked weapon—missiles that can receive target updates in-flight from satellites, drones, or other aircraft, dramatically increasing kill probability.

-

Asymmetric and Counter-Insurgency Needs: While high-tech peer conflict gets headlines, the demand for cost-effective, precision-guided bombs and missiles for counter-terrorism and close air support remains robust.

-

Geopolitical Instability: Regional conflicts and territorial disputes are compelling nations in Asia-Pacific, the Middle East, and Eastern Europe to bolster their aerial strike capabilities.

Key Technology Trends Shaping the Future

-

Increased Standoff Range: The proliferation of advanced surface-to-air missiles (SAMs) has made it suicidal to fly deep into enemy airspace. In response, long-range standoff weapons (e.g., Lockheed Martin’s JASSM-ER, MBDA’s Storm Shadow/SCALP) are becoming a cornerstone of air strategy, allowing strikes from hundreds of miles away.

-

Artificial Intelligence and Autonomy: AI is moving from the aircraft into the weapon itself. Collaborative munitions can now swarm a target, share data, and assign priorities autonomously. This overwhelms enemy defenses and complicates countermeasures.

-

Hypersonic Weapons: While largely in development, air-launched hypersonic missiles (traveling at Mach 5+) promise to compress decision times to minutes, posing an unprecedented challenge for current missile defense systems. Major powers are racing to field these capabilities.

-

Modular and Multi-Role Designs: Flexibility is key. Weapons like the GBU-53/B StormBreaker or SPEAR 3 can engage moving land targets, stationary armor, and even hostile ships with a single, configurable munition, reducing logistical burdens.

Market Segmentation: A Diverse Ecosystem

The market can be segmented in several ways:

-

By Platform: Fighter Aircraft, Bombers, Unmanned Combat Aerial Vehicles (UCAVs), Helicopter Gunships.

-

By Product Type:

-

Missiles: Air-to-Air (AAMs), Air-to-Surface (ASMs), Air-to-Ship, Cruise Missiles.

-

Precision-Guided Munitions (PGMs): Guided bombs of all sizes (JDAM, LGB, SDB).

-

Guns and Ammunition: Integrated cannons and pods.

-

-

-

By Guidance System: Infrared, Radar, GPS/INS, Laser, Electro-Optical, Multimodal.

-

Regional Hotspots and Competitive Landscape

-

North America (led by the U.S.) dominates the market in terms of expenditure and R&D, housing prime contractors like Lockheed Martin, Raytheon Technologies, Boeing, and Northrop Grumman.

-

Europe features strong consortiums like MBDA (a multi-national leader) and Saab, focusing on interoperability among NATO allies.

-

The Asia-Pacific region is the fastest-growing market, driven by China’s rapid indigenous weapons development (by entities like AVIC) and significant procurement by India, Japan, South Korea, and Australia.

-

Russia and Israel remain critical players, with Russia exporting its advanced missile tech and Israel (through Rafael, IAI) pioneering innovative systems like the “Spice” guidance kit and defensive aids.

Challenges on the Horizon

-

Skyrocketing Costs: The complexity of new weapons makes them exponentially more expensive, potentially limiting procurement numbers.

-

Export Controls and ITAR: Strict international regulations on arms sales can hinder market access and collaboration.

-

Supply Chain Vulnerabilities: Reliance on rare earth minerals and advanced semiconductors creates strategic dependencies.

-

Ethical & Legal Debates: The rise of autonomous weapon systems sparks intense discussion on the role of human-in-the-loop control.

Read More-

https://www.zionmarketresearch.com/de/report/aircraft-weapons-market

https://www.zionmarketresearch.com/de/report/aircraft-seat-actuation-system-market

https://www.zionmarketresearch.com/de/report/graphite-market

https://www.zionmarketresearch.com/de/report/biometrics-as-a-service-baas-in-healthcare-market

https://www.zionmarketresearch.com/de/report/lipstick-filling-machines-market

https://www.zionmarketresearch.com/de/report/aerostructure-composites-market

Conclusion: The Connected Munition is King

The future of the aircraft weapons market lies not in isolated bullets and bombs, but in intelligent, connected nodes within a larger “kill web.” Success will belong to those who can best integrate sensing, networking, and effects across all domains. As unmanned “loyal wingman” drones enter service, the very platform launching these weapons will evolve. For defense contractors and air forces alike, the mantra is clear: adaptability, precision, and connectivity are the new determinants of airpower. The race is on to build the smarter, faster, and more resilient weapons systems that will define the aerial battlespace for decades to come.